Studying abroad can change your life, but it’s not always easy. Many students dream of studying in a different country for a new experience. However, for students from low-income families, this dream can seem impossible. But now, there are options for funding your education if you want to study abroad. In this blog, we will provide all the information you need about education loans above 20 Lakhs for studying abroad.

What is an Education Loan?

An Education Loan, in terms of study abroad, refers to a loan that is specifically designed to cover the expenses related to an individual’s education abroad. These loans are provided by financial institutions and are typically used to cover tuition fees, living expenses, travel costs, and other educational expenses. Education loans for study abroad are available to students who wish to pursue higher education in a foreign country but may not have the financial means to do so on their own. These loans often come with different terms and conditions, including interest rates, repayment options, and eligibility criteria. They can be a helpful financial tool for students who want to pursue their educational goals overseas but require financial assistance to do so.

Types of Education Loans

There are two main types of education loans for study abroad:

1. Secured education loans

Secured education loans require collateral, such as property or a fixed deposit, to be pledged as security for the loan. This means that the lender has a claim to the collateral if the borrower defaults on the loan. Secured education loans typically have lower interest rates than unsecured loans, as they are considered less risky for the lender.

2. Unsecured education loans

Unsecured education loans do not require collateral. This means that the borrower does not need to pledge any assets as security for the loan. However, unsecured education loans typically have higher interest rates than secured loans, as they are considered more risky for the lender.

Also read: A Guide to Education Loan for Study Abroad for Indian Students

Here is a table summarizing the key differences between secured and unsecured education loans:

|

Feature |

Secured education loan | Unsecured education loan |

|

Collateral |

Required | Not required |

|

Interest rate |

Typically lower |

Typically higher |

| Risk for lender | Lower |

Higher |

| Eligibility | May be more difficult to qualify for |

May be easier to qualify for |

Types of Lenders Offering Education Loans Above 20 Lakhs

There are 3 main types of lenders offering education loans for study abroad:

1. Banks

Banks are a traditional source of education loans and offer a variety of options, including secured and unsecured loans, with varying interest rates and repayment terms. They typically have a strong reputation and a wide network of branches, making it convenient to access their services. However, their approval process may be more stringent, and they may require collateral for larger loan amounts.

2. Government-sponsored lenders

Governments often offer education loans through specialized agencies or institutions. These loans may have lower interest rates and more flexible repayment options, and they may not require collateral. However, they may have stricter eligibility criteria, and the application process may be more complex.

3. Private lenders

Private lenders, such as non-banking financial institutions (NBFCs) and credit unions, offer education loans to students who may not qualify for traditional bank loans or government-sponsored loans. They may be more willing to take on risk and provide loans to students with less credit history or lower credit scores. However, their interest rates may be higher, and they may have stricter repayment terms.

Also read: How to Get an Education Loan Without Collateral for Studying Abroad

Documents Required for Education Loan Above 20 Lakhs

The specific documents required for an education loan above 20 lakhs for study abroad may vary depending on the lender and the country where you are studying. However, here is a general list of documents that are typically required:

Personal documents

- Passport-size photographs

- Proof of identity (e.g., PAN card, Aadhaar card)

- Proof of residence (e.g., electricity bill, telephone bill)

- Academic documents (e.g., mark sheets, transcripts)

- Admission letter from the university you are planning to attend

- Offer letter from the university you are planning to attend (if applicable)

- Proof of scholarship or financial aid (if applicable)

Financial documents

- Income tax returns for the past two years

- Salary slips for the past six months

- Bank statements for the past six months

- Proof of assets (e.g., property papers, fixed deposit certificates)

- Proof of any other income sources (e.g., rental income, freelance work)

Co-signer documents (if applicable)

- Proof of identity of co-signer

- Proof of residence of co-signer

- Income tax returns of co-signer for the past two years

- Salary slips of co-signer for the past six months

- Bank statements of co-signer for the past six months

Additional documents

- Passport

- Visa

- Travel Insurance

- Health insurance

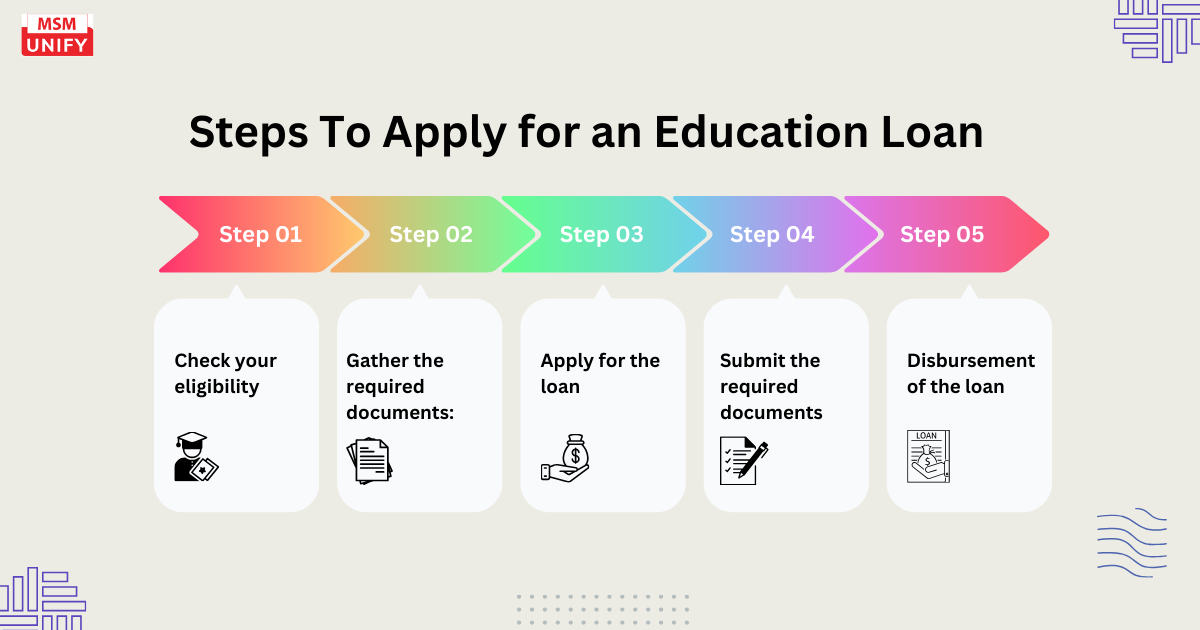

What are the Steps To Apply for an Education Loan Above 20 Lakhs?

Here are the steps on how Indian students can apply for an education loan:

Check your eligibility:

- Age: You should be at least 18 years old.

- Citizenship: You should be an Indian citizen.

- Admission: You should have secured admission to a recognized university or college abroad.

- Academic record: You should have a strong academic record.

- Co-signer: You may need a cosigner who is an Indian citizen with a good credit score.

Compare interest rates and terms:

- Interest rates: Education loan interest rates vary depending on the lender, the type of loan, and your credit score.

- Repayment tenor: The repayment tenor for education loans can range from 5 to 15 years.

- Fees: Some lenders may charge processing fees, prepayment fees, and late payment fees.

Gather the required documents:

- Personal documents: Passport, PAN card, Aadhaar card, address proof, etc.

- Academic documents: Mark sheets, transcripts, admission letter, etc.

- Financial documents: Income tax returns, salary slips, bank statements, etc.

- Co-signer documents: If you are applying with a co-signer, you will need their documents as well.

Apply for the loan:

- Online: You can apply for an education loan online by visiting the website of the lender you have chosen.

- Offline: You can also apply for an education loan offline by visiting the branch of the lender you have chosen.

Submit the required documents:

- You will need to submit copies of your personal documents, academic documents, and financial documents.

- You may also need to submit a copy of your co-signer’s documents.

Get pre-approved:

- Once your application has been processed, you will receive a pre-approval letter.

- This letter will state the maximum loan amount you are eligible for and the interest rate.

Accept the loan offer:

- If you are happy with the terms of the loan offer, you can accept it.

- You will need to sign the loan agreement and provide the lender with your bank details.

Disbursement of the loan:

- The loan amount will be disbursed to your bank account.

- You will start making repayments once your studies are complete.

Top 7 Education Loan Providers in India for Studying Abroad (above Rs. 20 lakhs)

| Education Loan Provider | Loan Amount (Unsecured) | Interest Rate | Moratorium Period | Processing Fees |

| UBI | Up to INR 40 Lakh | Starting at 9.8%* | Course + 12 months | No processing fee |

| HDFC Credila Education Loan | Up to ₹75 Lakhs | 9-14% | Up to 6 months | Up to 2.5% of the loan amount |

| ICICI Bank Education Loan | Up to ₹40 Lakhs | 9.86% onwards | Up to 6 months | Up to 2% of the loan amount |

| IDFC First Bank | Up to ₹01 crore | 2% above EBR (Current EBR is 9.75) | Up to 6 months | Nil |

| Axis Bank Education Loan | Up to ₹75 Lakhs | 13.70% to 15.20% | Up to 6 months | Up to 2.75% of the loan amount |

| Avanse Education Loan | Up to ₹40 Lakhs | 11.5% p.a. | Up to 12 months | 2% of the loan amount |

| Tata Capital Education Loan | Up to ₹30 Lakhs | 10.99% onwards | Up to 6 months | 2.75% of the loan amount |

How to Choose the Best Overseas Education Loan?

Choosing the best overseas education loan can be a daunting task, given the plethora of options available. However, by carefully considering your needs and preferences, you can narrow down your choices and find the loan that best suits your requirements. Here are some key factors to consider when choosing an overseas education loan:

1. Interest Rates:

Interest rates are a crucial factor influencing the overall cost of your loan. Compare interest rates offered by different lenders to find the most competitive rates. Remember to consider both fixed and floating rates and understand their implications for your repayment schedule.

2. Repayment Options:

Repayment options vary from lender to lender, so it’s important to choose one that aligns with your financial situation and future plans. Consider factors such as moratorium period, repayment tenure, and prepayment options to ensure a manageable repayment plan.

3. Processing Fees and Other Charges:

In addition to interest rates, there may be various processing fees, prepayment penalties, and other charges associated with education loans. Carefully review the fees charged by different lenders to avoid hidden costs.

4. Eligibility Criteria:

Ensure you meet the eligibility criteria of the lender, including age requirements, academic qualifications, creditworthiness, and collateral requirements. Some lenders may have specific criteria for overseas education loans.

5. Lender Reputation and Customer Service:

Choose a lender with a strong reputation for providing quality education loans and excellent customer service. Check online reviews, industry rankings, and feedback from previous borrowers to assess the lender’s reliability.

Obtaining an education loan for studying abroad is now easier than ever, as long as you have all the necessary documents and knowledge about the ideal type of loan for your foreign studies. Admission to a prestigious university as an international student significantly enhances your chances of securing the best loan for your overseas education! With the assistance of MSM Unify’s loan expert, you can even receive guidance throughout the loan process. The MSM Unify Expert will also connect you with the most suitable loan provider!

FAQs

Is it risky to take a loan and study abroad?

Both lenders and borrowers run a substantial risk when providing student loans. Unlike other loans, student loan repayment is more unclear since it depends so much on the possibility that students will pass their courses and find employment.

Is an abroad education loan worth it?

If you understand the risk, are up for the challenge, and are prepared for the worst. Then you should consult someone who has studied abroad. If they agree with you, then an education loan is worth the risk for you.

Is HDFC Credila accepted for a UK visa?

An overseas education loan from HDFC Credila is the only NBFC that is accepted by all the country embassies. Right from the USA, UK, Canada, Australia, New Zealand, and Germany the education loan from HDFC Credila is accepted by all the major study overseas destinations.

What is Modi’s education loan?

In order to enhance the education system and aid individuals in need, Prime Minister Narendra Modi has inaugurated the Vidya Lakshmi Portal. This platform provides comprehensive support for education loans and scholarships, consolidating all the necessary resources in one place.

Can I get an education loan without my parents?

If your credit score is under 650 and/or you do not have established credit, you will need a cosigner for a private student loan. It does not need to be a parent, however. It can be any person who is willing to cosign for you and who meets the credit criteria.